New Companies House Identity Verification Requirements

In our most recent AML quarterly update training, in partnership with The HAT Group, we covered the new Companies House verification requirements introduced by the Economic Crime and Corporate Transparency Act (ECCTA), which will help to mitigate the threats currently posed by the exploitation of individuals’ data. Identity verification will become a core requirement for company directors, people with significant control (PSCs) and those involved in company formation.

Designed to tackle fraud, improve transparency, and align UK standards with international best practices, the Companies House ID verification changes will impact accountants working with UK companies. Companies House has published three sets of rules that set out acceptable forms of evidence to be supplied and the application processes to be followed by applicants under each of the verification rules. From April 2025, voluntary identity verification begins, and the transition period for existing directors and PSCs spans 12 months, affecting over 7 million individuals.

Why the Rules Have Changed

Recent high-profile economic crimes exposed serious weaknesses in the UK’s corporate registration systems. The UK has long been criticised for the ease with which companies could be formed and controlled with minimal identity checks. This has made UK entities attractive vehicles for economic crime, including money laundering, fraud and the misuse of nominee directors. Companies House verification reforms aim to close those gaps.

Improving UK corporate trust and transparency

Economic crime costs the UK economy billions annually, with shell companies and false identities facilitating money laundering, tax evasion and terrorist financing. Mandatory ID verification is intended to ensure that individuals who run or control companies are real, traceable and accountable. Every director and PSC must prove their identity using government-approved methods (eliminating anonymous corporate control). Over time, this should improve the reliability of the public register and reduce abuse of corporate structures.

Aligning Companies House with AML regulatory standards

Until now, Companies House has largely relied on information submitted at face value. That position is changing. The new Companies House ID verification requirement is closer to the standards you already apply in your current AML compliance for client due diligence processes. There is now a clear expectation that identity checks, record keeping, and ongoing monitoring form part of a joined-up compliance framework. This should make it easier to position identity verification services as a natural extension of your firm’s current offering, helping clients to reduce their compliance burden.

Who Must Complete Identity Verification?

Companies House verification will be required for:

- All company directors, including those of corporate directors where permitted

- People with Significant Control (PSCs), including individuals who hold shares or voting rights above the relevant thresholds

- A “relevant legal officer” where a PSC is a legal entity

- Anyone acting as an Authorised Corporate Service Provider (ACSP), delivering ID verification services on behalf of others (e.g. accountants, Company Formation agents, and solicitors).

Company Directors, PSCs and Formation Agents

All company directors must complete ID verification regardless of appointment date or directorship type. This includes executive, non-executive and nominee directors across all company sizes and sectors (applies to UK nationals and overseas individuals). Biometric passports from any country are acceptable forms of photo ID under the rules.

PSCs (individuals holding more than 25% of company shares or voting rights) face identical requirements. If a PSC is a legal entity, that entity will need to appoint a “relevant legal officer”, whose identity must be verified within 28 days of notification.

Formation agents and ACSPs must also complete IDV for all directors before incorporating new companies and before appointing new directors to existing companies.

When Companies House ID Verification Must Take Place

Here is the timeline:

- From April 2025, individuals can voluntarily verify their identity

- From Autumn 2025, identity verification is mandatory for new directors and PSCs

- Existing directors and PSCs will have a 12-month transition period to complete ID verification, which must be done before their next confirmation statement is filed

- New directors must be verified before appointment

- New PSCs who are not directors must verify within 14 days of notification

- Legal entity PSCs must appoint a verified relevant legal officer within 28 days.

This creates varying deadlines across your client portfolio.

How the Identity Verification Process Works

There are two main routes to Companies House verification: directly (via GOV.UK One Login) or through an Authorised Corporate Service Provider.

Companies House direct verification route

Individuals can verify directly with Companies House using GOV.UK One Login. This can be done:

- Via the GOV.UK One Login ID Check app (requires a smartphone to scan biometric ID and facial recognition)

- Through the GOV.UK One Login website (requires document uploads and answering security questions)

- Face-to-face at a Post Office for those unable to use digital routes (the individual will need to request a Post Office interview whilst logged in tothe GOV.UK One Login website).

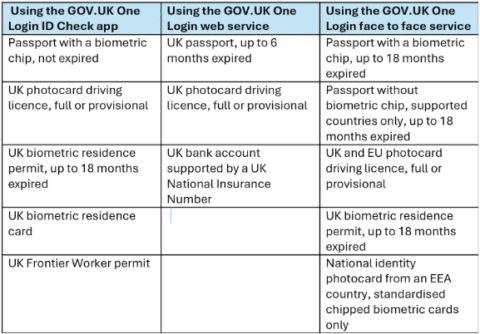

Each Companies House ID verification requires different documentation as per The Registrar’s (Identity Verification by the Registrar) Rules 2025 below:

Individuals must provide a unique email address, home address details, and approved identity documents. Biometric passports from any country provide the strongest evidence base, supported by various UK identity documents, including driving licences, residence permits and bank account confirmations. Once they’re successfully verified, the individual will receive a unique identifier number (their Companies House personal code) that will link their verified identity across all current and future roles and companies.

Verification via Authorised Corporate Service Providers (ACSPs)

As an accountant, you can provide Companies House verification checks on behalf of clients by registering as an Authorised Corporate Service Provider. A director, partner, or member of the firm must complete the initial registration (with a £55 registration fee). Once the firm is registered, other people can be added to the firm’s account. To act as an ACSP, firms must:

- Verify the identity of the person registering the firm

- Provide AML supervisor details and firm information

- Carry out identity checks using either identification document validation technology (IDVT) or manual document review by someone trained in detecting false documents

- Retain evidence and records of checks for seven years.

Companies House Verification

Identity verification is a structural change to how UK companies are governed. Don’t wait until deadlines loom – that just creates unnecessary risk for your clients and pressure on your practice. Early preparation, aligned AML processes and clear client communication are essential.

As part of ICPA’s enhanced membership offerings in partnership with The HAT Group, we’re committed to supporting independent practices by providing regular, relevant updates to help you stay compliant and informed. From regulatory guidance and quarterly updates to AML compliance training, ICPA’s goal is to ensure you have access to timely information that directly supports your practice’s needs. If you want to stay on top of the latest AML requirements, we are here to help.

Get the latest news direct to your inbox

Sign up to our mailing list to receive weekly bulletins on all of the latest accounting news.

"*" indicates required fields